Business Basics: Your Guide from Idea to Launch

From Idea to Launch

Starting a business is exciting, but it also requires thoughtful planning and compliance with state and local regulations. Below you’ll find a step-by-step guide with trusted local resources to support you at every stage.

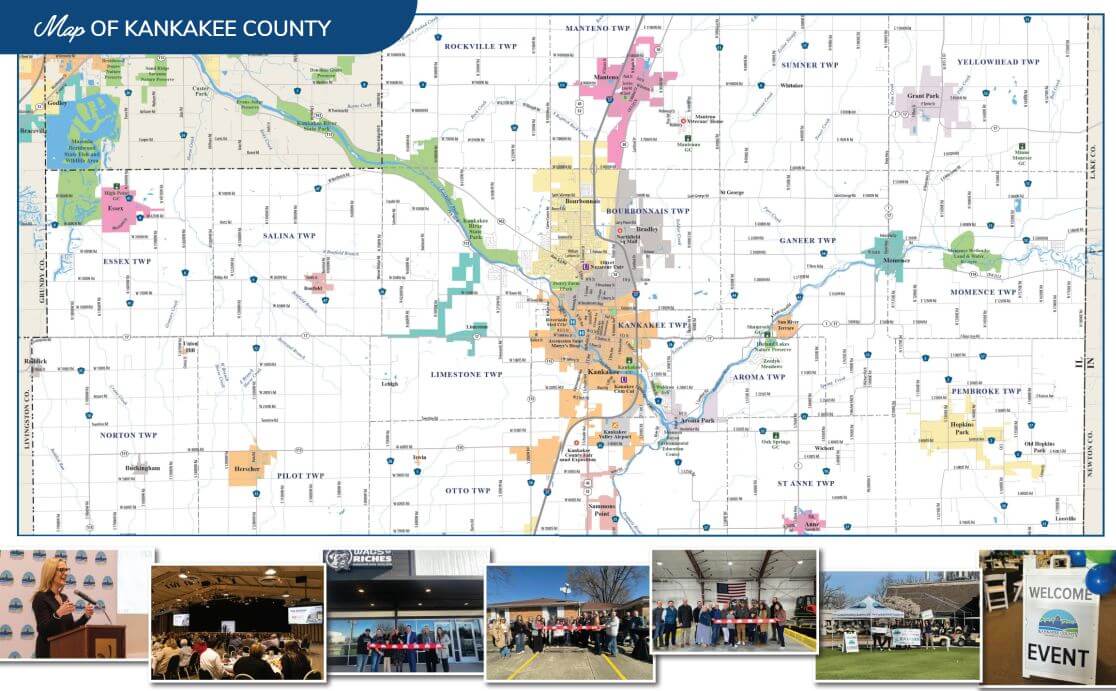

Economic Alliance of Kankakee County: The Economic Alliance of Kankakee County is a public-private partnership dedicated to fostering economic growth in Kankakee County, Illinois. Its mission is to create jobs and expand the economic base by improving the business climate through retention and expansion of established employers, recruitment of new employers, and business development.

Illinois Small Business Development Centers (SBDC): The Illinois Small Business Development Centers (SBDCs) offer no-cost, confidential support to entrepreneurs and small business owners across Illinois. They help with everything from starting a business to expanding or managing an existing one, offering guidance on business planning, marketing, financing, and more.

Small Business Administration (SBA): The Small Business Administration (SBA) is a federal agency that provides support to small businesses through loans, grants, counseling, and contracting opportunities. Its main goal is to help entrepreneurs succeed and promote economic growth.

Your Quick-Click Resource Hub:

Business Plan guide

Marketing Resources

- Marketing research and competitive analysis

- 10 Steps to start your business

- Publications & Business Guide

Financial Resources

1.Research & Planning

Before making financial commitments, conduct research to ensure your business idea is viable.

Key Steps:

- Conduct market research to identify your target customers, competition, and industry trends.

- Create a business plan outlining goals, marketing strategies, financial projections, and funding needs.

Local Resources:

- Illinois Small Business Development Center (SBDC) at Kankakee Community College – Offers free business planning assistance and market research support.

- Website: www.kcc.edu| Phone: (815) 802-8222

- Kankakee Public Library – Provides access to market research databases and business reference materials.

- Website: www.kankakeepubliclibrary.org| Phone: (815) 939-4564

2. Choose your Structure

Your legal structure affects taxes, liability, and operations. Options include:

- Sole Proprietorship – Easy to set up, but you are personally liable for business debts.

- LLC (Limited Liability Company) – Protects personal assets while offering flexibility.

- Corporation (C-Corp or S-Corp) – Best for larger businesses seeking investment.

Local Resources:

- Illinois Secretary of State – Business Services – Register your LLC or Corporation.

- Website: www.ilsos.gov| Phone: (217) 782-6961

- SBDC at KCC – Provides guidance on choosing the right structure for your business.

3. Register Your Business

Key Steps:

- Choose and register a business name with the Illinois Secretary of State.

- Obtain an EIN (Employer Identification Number) for tax purposes and hiring employees.

- Register with the State of Illinois if forming an LLC or corporation.

Local Resources:

- Illinois Secretary of State – Business Registration

- Website: www.ilsos.gov

- IRS – Apply for EIN

- Website: www.irs.gov

5. Set Up Finances & Taxes

Key Steps:

- Open a business bank account to separate personal and business finances.

- Set up accounting software or hire an accountant.

- Register for state taxes if selling goods or services.

Local Resources:

- Illinois Department of Revenue (IDOR) – Handles state sales tax and employer taxes.

- Website: www2.illinois.gov/rev

- Local Banks & Credit Unions – Offer business banking services.

- Local Small Business Accountants – The Chamber can connect you with CPAs.

6. Secure Funding

Starting a business often requires capital. Consider:

- Small business loans from banks and credit unions.

- Grants and incentives from local and state programs.

- Alternative funding such as investors or crowdfunding.

Local Resources:

- Kankakee County SBDC – Helps businesses apply for loans and grants.

- Kankakee County Economic Alliance – Provides financial resources for small businesses.

- Website: www.kankakeecountyed.org

7. Set Up Operations & Marketing

Key Steps:

- Find a business location and check zoning laws.

- Obtain business insurance to protect against liability.

- Develop a marketing plan and establish an online presence.

Local Resources:

- Kankakee County Chamber of Commerce – Offers networking, business promotion, and marketing support.

- Website: www.kankakeecountychamber.com

- Kankakee Small Business Development Center (SBDC) – Offers marketing strategy assistance.

- Google My Business – Free online business listing.

- Website: www.google.com/business

8. Hire & Train Employees (If Needed)

Key Steps:

- Comply with federal and state labor laws.

- Obtain workers’ compensation insurance if hiring employees.

- Develop employee policies and training programs.

Local Resources:

- Illinois Department of Employment Security (IDES) – Provides employer guidelines.

- Website: www.ides.illinois.gov

- Kankakee Workforce Services – Helps with recruitment and employee training.

- Website: www.kcc.edu/workforce

9. Launch & Grow Your Business

Once everything is in place, it’s time to open your doors!

- Plan a grand opening event.

- Engage with the Chamber of Commerce and other local business networks.

- Monitor financial performance and adjust as needed.

Local Resources:

- Kankakee County Chamber of Commerce – Offers ribbon-cutting ceremonies, networking opportunities, and marketing support.

- Kankakee County Economic Alliance – Provides business growth resources.

ComEd released new grant opportunities for our communities.

Green Region Grant Program supports the efforts of nonprofit, educational, and public organizations to improve and protect open spaces.

The Powering Safe Communities Grant Program supports public safety and clean transportation initiatives. In the past these funds have been used to purchase speed radar machines, AEDs, battery-powered tools and chargers.

The grants are open through March 13, 2026. Visit ComEd.com/Grants for application instructions.

The press release is attached for your reference. Please reach out if you have any questions.

ComEd Offering $515,000 in Grants to Support Community Programs Across Northern Illinois

Applications now open for ComEd’s three Power for Good Grant Programs, awarding grants to support community organizations across northern Illinois

CHICAGO (January 12, 2026) – ComEd is now accepting grant applications for three of its Power for Good Grant Programs. This year’s annual program will provide a total of $515,000 in funding to municipalities and nonprofit organizations to strengthen environmental sustainability efforts, advance public safety and clean transportation projects and broaden access to arts programs.

The three Power for Good grant programs accepting applications are Green Region, administered by Openlands; Powering Safe Communities, administered by the Metropolitan Mayors Caucus; and Powering the Arts, administered by the League of Chicago Theatres.

Organizations and municipalities are encouraged to apply for these grant programs and visit ComEd.com/Grants for application instructions. Applications will be accepted for all three grant programs through 5 p.m. CT on March 13, 2026.

“At ComEd, we’re honored to invest in programs that improve the quality of life of the customers we proudly serve across northern Illinois,” said Melissa Y. Washington, Senior Vice President of Government, Regulatory and External Affairs at ComEd. “Through our Power for Good grants—and in partnership with Openlands, the Metropolitan Mayors Caucus, and the League of Chicago Theatres—we’re able to deliver meaningful impact in communities year after year.”

This annual competitive grant program is part of ComEd’s commitment to community investment. To date, these programs have delivered nearly $6 million in funding to support hundreds of community-based projects. All funding is provided by ComEd and stays in northern Illinois.

The Green Region Grant Program, in partnership with Openlands, supports the efforts of nonprofit, educational, and public organizations to improve and protect open spaces. Now in its 14th year, the grant program has supported the development of more than 86,000 feet of ADA-accessible trails, 1,800 acres of restored land and the planting of almost 39,000 new trees. A summary of 2025 Green Region grant recipients can be found here.

“At Openlands, we believe that healthy communities are rooted in land as the foundation of a connected, resilient region where people and nature can thrive together. Our longstanding partnership with ComEd reflects our continuous support to projects that increase access to green space, strengthen local stewardship and empower communities to care for the natural areas that sustain us all,” said Michael Davidson, President and CEO of Openlands. “Protecting critical habitats and expanding natural spaces is a shared commitment to building a more resilient, equitable and vibrant region for today and for generations to come.”

The Powering Safe Communities Grant Program, in partnership with the Metropolitan Mayors Caucus, supports public safety and clean transportation initiatives. These grants support projects designed to increase public safety, reduce carbon emissions and improve community resiliency. A summary of 2025 Powering Safe Communities grant recipients can be found here.

“The Metropolitan Mayors Caucus is honored to partner with ComEd for the 12th year through the Powering Safe Communities Grant Program,” said Neil James, Executive Director at Metropolitan Mayors Caucus. “Equipping our communities with infrastructure and financial support through this program creates a cleaner and safer future. This year’s grant funding will help increase safety, improve air quality and accelerate the transition to an electrified future across northern Illinois.”

The Powering the Arts Grant Program, in partnership with the League of Chicago Theatres, recognizes that access to the arts brings vibrancy to local communities. Now in the program’s ninth year, these grants support programs and workshops across northern Illinois communities that boost public awareness, engagement and enjoyment of the arts. A summary of 2025 Powering the Arts grant recipients can be found here.

“The League of Chicago Theatres is proud to continue this longstanding partnership with ComEd through the Powering the Arts Grant Program,” said Marissa Lynn Jones, Executive Director of the League of Chicago Theatres. “This grant program empowers our communities and organizations to develop creative methods to connect with and inspire their audiences through art. We appreciate ComEd’s efforts to support diverse, expressive communities in northern Illinois.”

For more information on each grant program, including eligibility guidelines and how to apply, visit ComEd.com/Grants.

###

ComEd is a unit of Chicago-based Exelon Corporation (NASDAQ: EXC), a Fortune 200 company and one of the nation’s largest utility companies, serving more than 10.7 million electricity and natural gas customers. ComEd powers the lives of more than 4 million customers across northern Illinois, or 70 percent of the state’s population. For more information, visit ComEd.com, and connect with the company on Facebook, Instagram, LinkedIn, X and YouTube.

###

Direct link to the general DCEO posting site for application documents: Apply for Funding - Grant Opportunities

$5 Million – Illinois Overflow and Sewer Grant

Purpose: Supports local governments in addressing combined sewer overflows (CSOs), sanitary sewer overflows (SSOs), and stormwater management to improve water quality.

Eligible Applicants: Government Organizations.

· No match required for:

o Rural communities (population < 10,000)

o Financially distressed communities (population <30,000 with median household income <70% of the state average.

Deadline: January 1, 2027, or until all funds have been expended.

Apply via: Grant Accountability and Transparency Act Grantee Portal.

$788,000 – Gulf Hypoxia Program

Purpose: Reduce nitrate pollution in Illinois surface waters by funding nonpoint source edge-of-field control projects as part of the Gulf Hypoxia Program.

Eligible Practices:

1. Denitrifying Bioreactors – Remove nitrates from water

2. Saturated Buffers – Filter water before it reaches streams

3. Constructed Wetlands – Treat and clean water

Eligible Applicants: Individuals, Small Businesses, Others, Government Organizations, Education Organizations, Nonprofit Organizations, For-Profit Organizations.

· Projects must be in priority watersheds where water drains into the Gulf of Mexico and use at least one of the above best management practices.

Deadline: January 1, 2027, or until all funds have been expended.

Apply via: Grant Accountability and Transparency Act Grantee Portal.

DCEO has announced $31.5 million in funding as part of the Regional Site Readiness Program.

Eligible applicants include:

- Local governments

- Economic development organizations

- Nonprofit organizations

- For-profit organizations

- Private landowner

Eligible projects include (but not limited to):

- Land acquisition and related expenses

- Appraisal, surveying, real estate, and legal fees

- Title transfer taxes

- Land preparation, if done as part of a larger grant funded, bondable project

- Clearing, grading, drainage

- Infrastructure expenses

- Utility construction

- Roadway construction

- Water and sewer construction

- Rail access

- Environmental remediation, if done as part of a larger grant funded, bondable project

More info for this program can be found here: https://dceo.illinois.gov/aboutdceo/grantopportunities/3429-3152.html\

Illinois Returning Residents Clean Jobs Program

Program Details: This program will deliver clean jobs training in Illinois Department of Corrections facilities to individuals within 36 months of their release to prepare them to work in clean energy and related sector jobs upon release. The program provides classroom instruction and hands-on learning opportunities, utilizing a standard Clean Jobs Curriculum Framework, connecting program graduates with potential employers in the clean energy industry, and addressing participant needs.

Eligible Applicants: Community-based organizations providing employment, skill development, or related services to members of the community; include community colleges, nonprofits, and local governments; and, have a history of serving committed persons or justice involved persons.

Application Deadline: Rolling

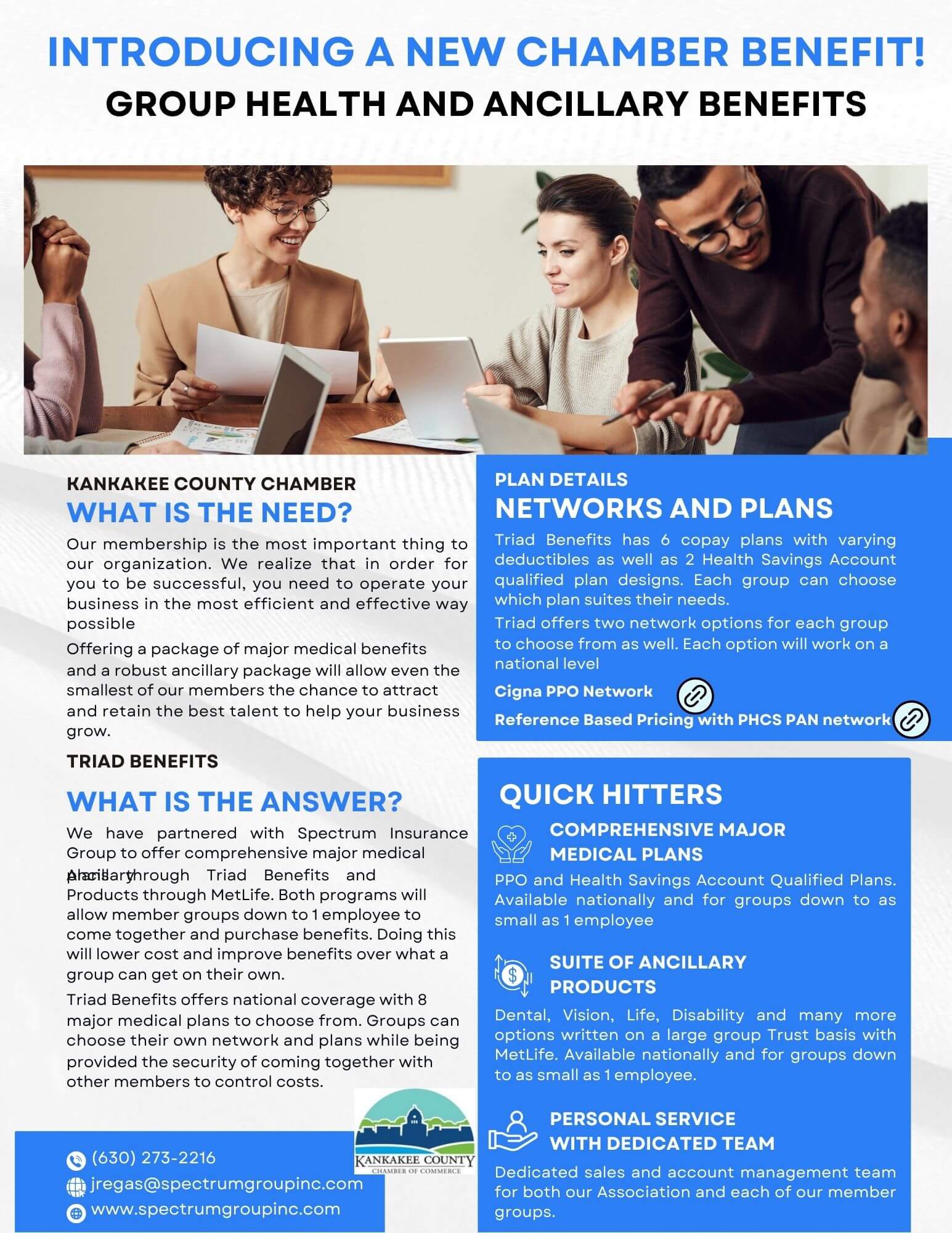

Spectrum Insurance Group- 2025 Creative Benefit Consultants Program Overview

United Health Care - 2025 Community Chamber Program

From Then to Now – See What Our Community’s Been Up To!

Need More Help?

The Kankakee County Chamber of Commerce is here to support you! Contact us for personalized guidance, networking opportunities, and access to local business resources.

Website: www.kankakeecountychamber.com

Phone: (815) 351-9068

Let’s build a thriving business community together!